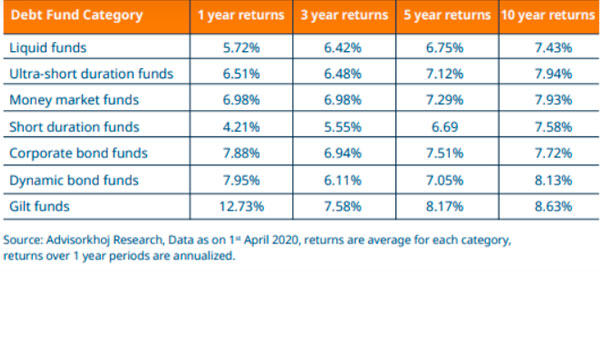

When it comes to picking debt mutual funds for your portfolio, paying close attention to the interest rate cycle is paramount. If you have just started dabbling with debt fund investments or are planning to do so, understanding the relationship between interest rate fluctuations and debt mutual funds is vital.

For debt fund investors, the interest paid on fund holdings is not the sole income source. Mutual funds majorly invest in bonds that are also traded in the debt market and as is the case with anything traded on a market (for instance equities are traded on a stock exchange) the prices of bonds fluctuate. Now when there is a price increase of a bond, those who have invested in it make additional gains and they can also incur losses when the price of a bond falls but that depends on their coupon payments. If the interest or coupon payment is higher than the fall in the price, it offsets the depreciation.

Now the movements in bond prices are intricately linked to the interest rate cycles in the economy. Bond prices change when the interest rates change or even when a change is anticipated. The Reserve Bank of India pulls the interest rates higher when the economy is teetering on an inflationary phase and slashes interest rate when it is going through a slump. As we discussed in a previous article, bond yields (interest rates) and its prices move in opposite directions.

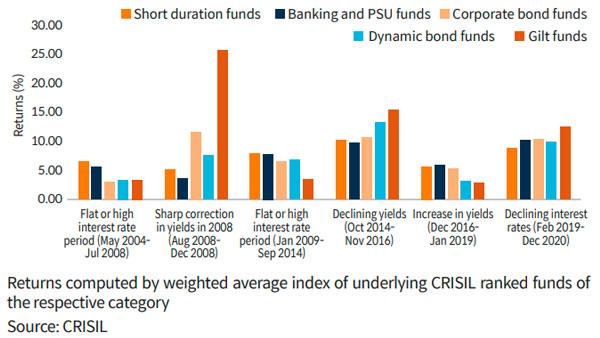

When interest rates rise, costs incurred by coupon issuers increase as now they would have to pay higher interest rates. To mellow down the impact of the extra costs, they issue more short term bonds because obviously higher interest long term bonds would cost more. This increases the supply of short term paper and investors can choose mutual funds that buy them so that they can reap the benefits of higher interest payments.

In general, debt funds with longer maturity periods are more prone to fluctuations in values due to changes in interest rates than short-term debt funds – the longer is the duration, the higher are the chances of interest rate changes. Hence when interest rates are rising it’s better to invest in short-term debt funds than ones with longer maturity periods.

Disclaimer: An Investor Education Initiative by Mirae Asset Mutual FundFor information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint, refer to the knowledge center section available on the website of Mirae Asset Mutual Fund

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

As investors, the journey of investments is a long and a constantly evolving one at that with numerous climaxes and plot points...

Read More...

The right asset allocation mix can provide ample opportunities for investors for tapping into the earning potential of equities while maintaining stability with debt instruments. However, decoding the right asset ...

Read More...

As is the case in our day-to-day lives where we often find ourselves realizing the importance of the axiom that “variety is the spice of life”, in the world of personal finance too, variety has an important place.

Read More...

The growth trajectory of the Indian economy over the last few decades has undoubtedly captured the attention of the world. However, the growth story continues

Read More...

Equity savings funds are open-ended mutual fund schemes in which the investments are spread across equity and debt funds and arbitrage securities.

Read More...

Smart investing is all about finding the right balance between risks and returns. By diversifying your portfolio with the appropriate mix of stable assets

Read More...

With increased focus on the environmental challenges plaguing various countries and communities in the world, there has been a marked shift in the way people are viewing their responsibilities in making the world a better place to live in.

Read More...

It is common knowledge that the future of our environment is in a precarious position and has become a priority for governments and businesses across the globe.

Read More...

Over the last few years, the world of investing has witnessed several shifts in the values that govern investments.

Read More...

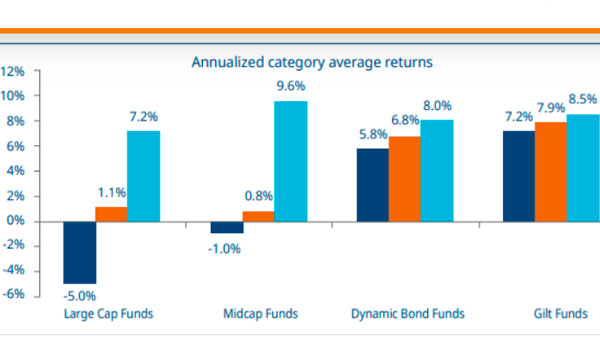

The performance of debt mutual funds is intertwined with interest rate movements as the latter have a significant bearing based on the funds’ yield-to-maturity.

Read More...

Hybrid funds can be an excellent tool for investors to make the best of equity and debt asset classes. They provide ample opportunities for investors for tapping into the earning potential of equities while maintaining stability with investments in debt instruments.

Read More...

Decoding asset allocation can be a daunting task for many investors especially for those who are new to managing investments.

Read More...

A popular English axiom goes: “Variety is the essence of life.” In the world of personal finance too, variety has an important place. Financial planners, investment gurus and fund managers use the term diversification and it is considered one of the building blocks of a successful financial strategy.

Read More...

For many investors, foraying into the journey of investments and gauging the right mix of investment classes can be akin to finding the right ratio of ingredients for baking the perfect cake.

Read More...

>“But what if the market is in a terrible condition when the timeline of my goal is nearing and I am about to redeem my equity investment?” For investors who shy away from equity investments owing to the risks involved, the fear ...

Read More...

The beauty of hybrid fundsis that they come in all shapes and sizes – whether you are a conservative investor or have a high risk tolerance, hybrid schemes afford you the flexibility of maintaining your equity and debt...

Read More...

Dabbling in equities can seem daunting if you are new to the world of investments. Yes, the charm of high returns can seem hard to repel and it may evoke a misplaced sense of...

Read More...

No financial plan is complete if it has no mention of an emergency corpus. An emergency corpus acts as shock absorber in times of distress...

Read More...

During its second bi-monthly monetary policy review for 2021-2022, the Reserve Bank of India announced that it would be keeping the main policy rates unchanged.

Read More...

My journey in the world of mutual fund investing is marked with phases where I had to teach myself new things and unlearn a lot of preconceived notions about mutual fund investments.

Read More...

In the last few months of 2020, the Indian economy’s recovery from the blows wielded by the first wave of the coronavirus pandemic was stable enough to make market mavericks

Read More...

The resurgence of the coronavirus pandemic has cast doubts on the recovery of India’s economy.

Read More...

In India, fixed deposits continue to dominate the terrain of ‘comfort investments’ for a sizable section of investors. to guaranteed returns and low risks associated with fixed deposit investments, they have been the go-to investment option in India.

Read More...

Ask any market maven and they will tell you that for building a strong investment portfolio, you need to have a clear idea about your goals and the horizon for them. That forms the crux of investment choices.

Read More...

When it comes to picking debt mutual funds for your portfolio, paying close attention to the interest rate cycle is paramount. If you have just started dabbling with debt fund investments...

Read More...

If you have recently forayed into the arena of debt fund investments or are planning to do so, then understanding how interest rate fluctuations can impact your...

Read More...

When it comes to building a portfolio that can withstand ripples in the market and generate returns suited to your goals, the addition of debt mutual funds like...

Read More...

When it comes to debt fund investments, credit ratings of companies issued by credit rating agencies is considered to be the guiding light for investors.

Read More...

At a time when the markets and economy are recuperating from the inflictions caused by the COVID-19 pandemic, investors remain in a grey zone.

Read More...

For Anusha, the stream of losses that she incurred in her corporate bond fund portfolio came as a rude shock to her. She had purchased various corporate bonds in the last few months but what with Anusha

Read More...

In October 2020, data from the Association of Mutual Funds showed that debt schemes and corporate bond funds clocked the biggest inflows in more than a year.

Read More...

When investing in a debt instrument, the first consideration ‒ and for many of us the only material one ‒ is the yield to maturity (YTM) it offers.

Read More...

Bank fixed deposits (FDs) have traditionally been the most favoured debt investment option among Indians. But not anymore. With interest rates on FDs falling, especially over the past one year,

Read More...

By investing a fixed amount every month (or any other interval) from your regular savings, you can invest over a long period of time and benefit from the power of compounding.

Read More...

Debt funds are fixed income mutual fund schemes which invest in debt and money market instruments like CPs, CDs, Corporate Bond, T-Bills, G-Secs etc.

Read More...

The equity market's stellar performance has beckoned many investor to take huge exposure to the asset class. Though equity is one of the best wealth creators in the long term, it is prudent to include a less risky asset class such as debt to balance the investment portfolio.

Read More...

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.As per Reserve Bank of India’s Quarterly Estimates of Household Financial Assets and Liabilities, Rs 4,753 billion was invested in bank FDs in FY 2018.

Read More...

In Episode 4 of ‘Winning Over Volatility, we evaluated how banking & PSU funds stand amid the economic downturn, and the dos and don’ts of investing in this category.

Read More..._1593088451941_1593088462624.jpg)

Episode 3 of ‘Winning Over Volatility’ shed light on ETFs and their rising popularity, how they compare to mutual funds, and whether now is the right time to invest in ETFs.

Read More...

In Episode 2 of ‘Winning Over Volatility’, organized in association with Mirae Asset Investment Managers (India) Pvt Ltd., we discussed how one should go about investing in debt funds, especially in light of the current economic downturn.

Read More..._1589893779393_1589893779609.jpg)

Swarup Mohanty, CEO, Mirae Asset Investment Managers (India) Pvt.Ltd, will join us for a discussion on May 22. It will focus on why it’s important to stay invested in the face of a pandemic, and the best way to go about it

Read More...

In the first episode of ‘Winning Over Volatility’, the CEO of Mirae Asset Investment Managers (India) Pvt.Ltd talks about rising investor maturity in India, the 2008 economic crisis, and more.

Read More...IE Disclaimer

An investor education initiative by Mirae Asset Mutual Fund.

For information KYC process, Registered Mutual Funds and the procedure to lodge a complaint, refer knowledge centre section available on the website of Mirae Asset Mutal Fund.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.